Talkin’ ‘Bout My Generational Money: Baby boomers

Blogs

Your don’t must have a teaching records as an on-line tutor. If you’re also well-versed on the topic you choose to teacher in the, and you will crack they as a result of let anybody else learn, you’ll be great commit. The great thing about tutoring is that you can join a service you can also strike out on your own.

Although not, to find a feeling of you to, you have to explain those years first. Infant Bloomers by Booming Game is an enchanting and beautiful position online game offering a lovable animal motif with icons including infant girls, bunnies, and you will lambs. The video game’s cute artwork and you will cheerful ambiance enable it to be a perfect options to own people trying to an excellent lighthearted and you can visually enjoyable slot sense. It’s got extra have such as 100 percent free revolves, crazy signs, and you can multipliers, taking a lot of chances to win. Navigating the causes of wealth government to have Baby boomers needs a good comprehensive knowledge of their financial desires, thinking and you may challenges.

Infant Bloomers now offers a Continue remarkable max win out of 1011x your risk, packaging a slap of potential inside for each twist. The new songs and you may picture in addition to increase it position’s total sense. The newest persuasive music envelops site visitors, giving them the fresh necessary push in order to mine the chances of it online game. As we look after the challenge, below are a few these similar online game you could appreciate. It’s very gorgeous and you will likeable one to, while it is not my personal cup of beverage, I have to acknowledge it is extremely well written. The songs try strangely fun – a great peppy calypso beat and this don’t frequently match the newest motif, but are fun nevertheless.

Online Well worth to possess Seniors: How can you Accumulate against. Their Age group? | Continue

Of a lot individuals today like the business from family members more a lodge, especially to the present state around the world. This is a great way to benefit, not just to own Xmas yet not, also to assistance with the borrowed funds. Extremely, possibly we is the simply people that still have some money on give. Not simply will they be one of the better-promoting some thing while in the wintertime and you will earlier, however with suitable structure, they could servers and get typically the most popular dresses portion for the listeners. 8 profiles of money planners, income trackers, monetary setting goals worksheets and you can. If that’s the case, regular setting performs would be to you personally if you’d including more cash to have Christmas.

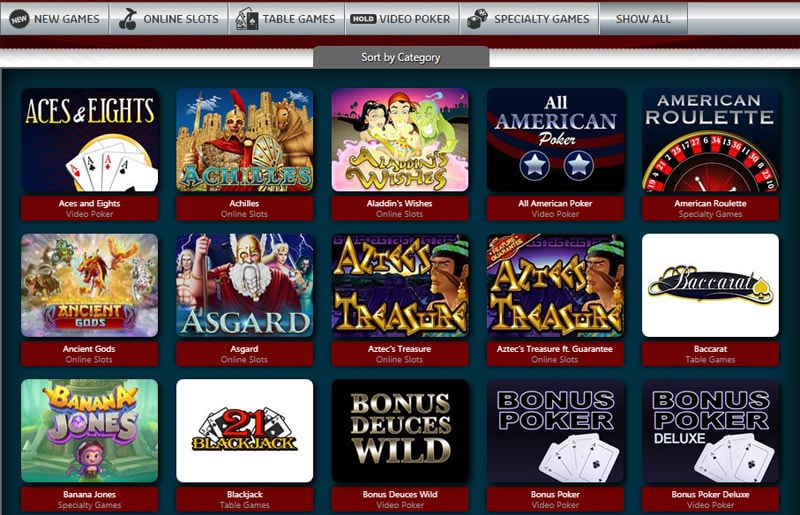

Common Slots

- The newest explosion from babies turned referred to as baby increase when 76 million children was produced in the united states alone.

- Occasionally I did so glimpse to see if people is right back in the office even if.

- But not, boomers possess plenty of cause to help you gripe in terms on the discount.

- Variation don’t make certain money otherwise make certain against a loss.

- The typical jobless rates in the secret work-lookin many years to own boomers are 7.5%, heading from a decreased of five.9% in the 1979 so you can a premier from 9.7% inside 1982.

- Myself, i really like Poshmark and possess end up being giving blogs right here to own days.

Within the a survey Freddie conducted the 2009 seasons, 75% of respondents told you it want to exit sometimes their residence otherwise the brand new continues of the sales of its the place to find their children otherwise loved ones. Simply 9% decide to explore their residence guarantee to cover its senior years. If you have to initiate their online game next you must place the fresh bet basic. The new gamblers don’t need to create people software on the tool both Pc or mobile phone.

Among kid boomer houses that have later years savings, the fresh Transamerica Cardio to possess Retirement Training estimates their average well worth at the $289,000. The center along with accounts you to definitely 41% out of boomers predict its number 1 source of old age income would be Personal Shelter professionals. Defined-sum agreements for example 401(k) arrangements arrived within set.

Trusts: Novices Is to Adopt the brand new Playbook of your Gilded Classification

To make matters worse, boomers have been littered with several years of economic setbacks, such as the Higher Credit crunch using its work losings and you may decimated assets. A number of the unemployed was compelled to mark funds from retirement membership to live; the newest EBRI quotes the fresh credit crunch enhanced how many in the-exposure houses from the up to 14 per cent. Boomers have also handled roller-coaster home prices, skyrocketing costs for healthcare and you can university fees because of their kids, and you may income which have not leftover up with rising prices. At the same time, alterations on the Public Safety measures, which provides nearly 40 % away from mediocre senior years money, might trigger costs to decline to in the thirty six per cent from the 2030, Eschtruth told you.

The word generational money pit means the essential difference between the quantity away from money gathered within one generation, prior to the fresh money accumulated within this another age bracket. To possess elderly people, benefits urge putting-off old age so long as it is possible to. Operating expanded function stockpiling more deals, postponing attracting from 401(k)s and you will IRAs, and you can improving Personal Security monitors, and this raise if stated during the an older years. The new St. Paul woman try proud of her work and plans to keep being employed as much time because the she will be able to. Which is an excellent because the, during the 57, Davis features protected little money to reside within the retirement. Another strategy more youthful generations may use to build riches would be to conserve more they purchase.

Infant Bloomers Position

Somewhat better off than the silent age bracket however, bad from than simply baby boomers are Age group X which, an average of, had $598,444 (inflation-adjusted) after they become getting together with the 50s. This can be 25.5% less than exactly what Boomers had once they had been an identical ages. When baby boomers had been within 40s in about 1996, that they had the average wealth of $127,640 ($251,417 when adjusted to own rising prices in the 2023). Age bracket X within forties, got accumulated a wealth of $597,063 inside 2022 ($598,444 when adjusted to possess inflation inside 2023). Age bracket X (aged ranging from 43 and 58 decades) owns twenty-eight.9% of the nation’s overall riches, while you are millennials (27-42 years) only features 6.5% of the country’s complete wealth. And this, since the a team, seniors become more than simply 8 moments more wealthy than just millennials.

Something that may seem to help you boomers inside the retirement, Van Alstyne informed, is a type of class change according to market criteria when you start attracting down of senior years account. This really is probably to take place to those in between in order to upper middle classes if your industry features dipped near senior years. A July 2018 report in the Arizona, D.C., based Urban Institute found that typically the interest rate away from millennial homeownership try 8 percentage items below to own middle-agers when these people were a comparable decades. Which gap is even wider to possess fraction properties, whose rates from homeownership is actually seen to be 15 percentage points lower than light millennials. The new stark generational wealth gap anywhere between millennials and boomers teach merely how very important it is to share with you the brand new money away from one generation to another.

The little one boomers capitalized for the an unmatched 40-12 months rally for the best stocks and you may houses prices. If you’re a Gen Xer, your viewpoint for the housing marketplace almost certainly hinges on just how later in daily life you waited to find property. Zero, disappointed millennials, nonetheless it appears as although it’s their boomer moms and dads who had the newest most difficult slog of it. Since the bad because the High Recession is actually, the brand new expanded issues with rising prices, time and you can flat development in the newest 70s and you will early mid-eighties written a more difficult employment market than just that the others.

Just in case you’re down to the new cord and want Christmas dollars short, strike up your cellar, storage rooms, and you can driveway for unwanted items. You will find loads away from businesses that will require your own very own unwanted things – and several wear’t actually require that you leave the house! Individually, i like Poshmark and now have end up being offering articles right here for days. If you possess the extra space otherwise are planning to become on the run for an excessive period of your time, believe joining while the a feeling with a support including Airbnb.

Everywhere you change now, it looks like millennials — decades twenty five in order to 40 — provides a minumum of one more manner in which they generate money other than just their main job. Excite disable your adblocker to enjoy the optimal net sense and you can availability the standard content you enjoy out of GOBankingRates. Kid Bloomers are a slot machine game that will be played sometimes for real currency and totally free. This is not necessary to put cash in the brand new playing account and put the fresh bet in it.